The forward price for the option's expiry used in the Black 76 model to calculate option mark prices.

$0.00

Time to Expiry

00:00:00

Strike Price

The fixed price at which an option can be exercised to buy (call) or sell (put) the underlying asset.

Break Even

The underlying asset price at which profit begins after covering the option premium.

To Break Even

The percentage price movement required in the underlying asset for the option to reach breakeven.

Price

Option prices for traders, adjusted by subtracting (mark price - risk premium) or adding (mark price + risk premium), for selling and buying respectively.

IV

The expected volatility of the underlying asset, adjusted by subtracting (market - bid) or adding (ask - market) divided by Vega, for selling and buying respectively.

24H Change

Represents the percentage change in price since 00:00 UTC, indicating the option's price movement over the past 24 hours.

Volume

Trade Options

Buy/sell options by choosing call/put, strike price and expiry.

Seamless Options, Anytime

Moby Option is a European-style contract, exercisable only at expiration, while allowing traders to buy and sell at prevailing market prices anytime before expiry.

Backed by continuous liquidity, Moby ensures seamless and immediate execution at all times.

Call Buy

Buy a call to gain exposure to potential price increases. If the market price exceeds the strike at expiration, you can exercise the option or sell it for a profit.

Short-term Expiry (< 7d)

Short-Term Options offer higher leverage and volatility, making them ideal for quick trades.

Learn more from the Moby Simple Guide

Open Positions

History

Open Positions

0

Position Value

$0.00

Invested

$0.00

Collateral

$0.00

P&L

$0.00

ROI

0.00%

0-0 of 0

Instrument

Option Size

Avg. Price

Price

P&L (ROI)

Profit or loss calculated as price difference (price - average price for buy, average price - price for sell) multiplied by size, with ROI expressed as (P&L/price × 100).

Cashflow

Amount paid or received for the options traded.

Delta

Changes in options price due to $1 increase in underlying asset's price per quantity.

Gamma

Changes in Delta due to $1 increase in underlying asset's price per quantity.

Vega

Changes in options price due to 1% increase in underlying asset's IV per quantity.

Theta

Changes in options price per day closer to expiry per quantity.

Actions

No open position

Dashboard

Docs

Telegram

Discord

Blog

© Moby. All rights reserved.

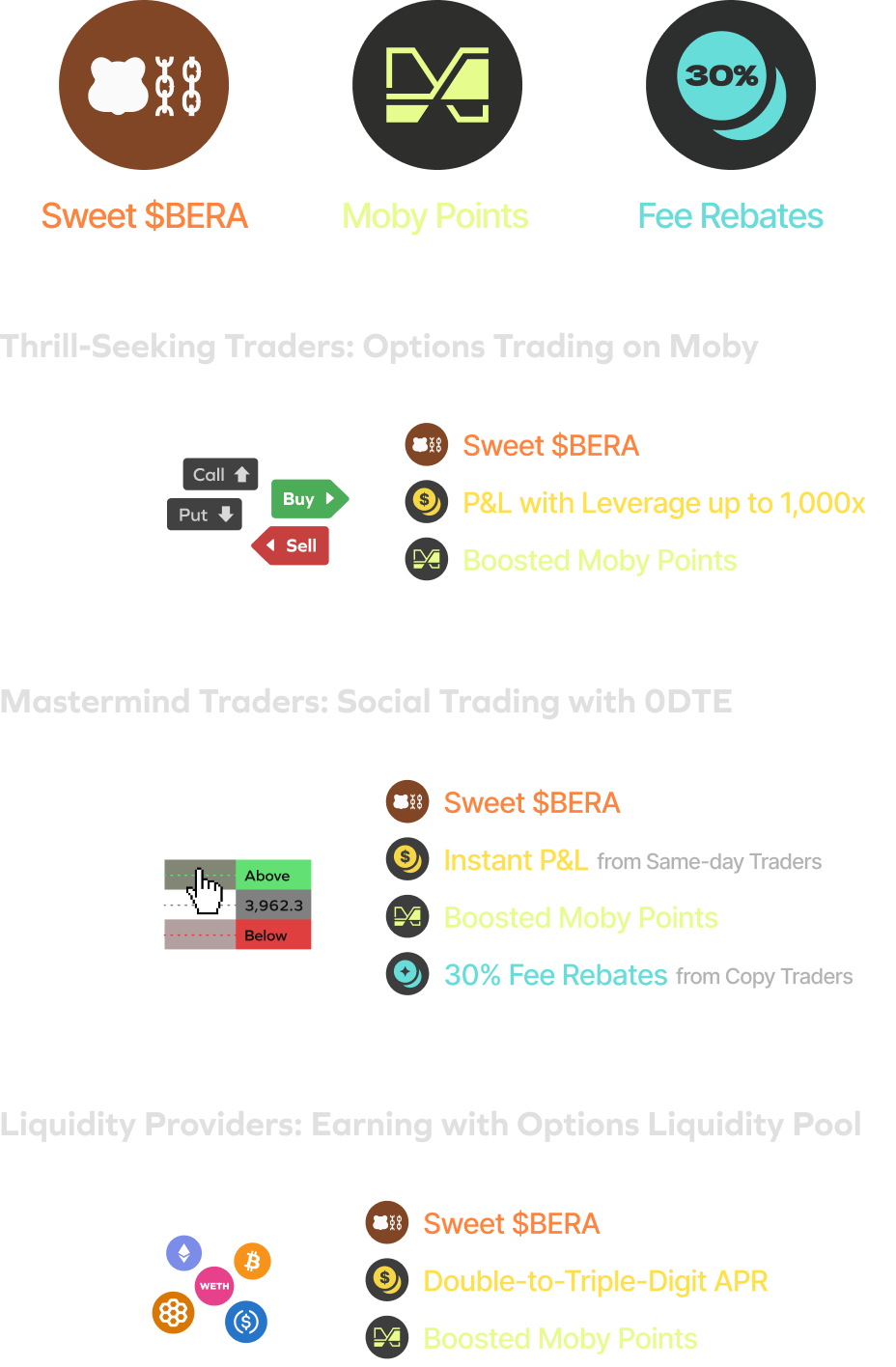

Ready. Set. Earn

Maximize Your Earning on Berachain